The automotive industry is on the brink of a major shakeup as proposed 25% tariffs on vehicles and parts imported from Canada and Mexico threaten to disrupt cross-border supply chains. Automakers that rely on these trade routes could see production costs skyrocket, leading to higher car prices for consumers.

With profit margins already hovering around 10%, these tariffs could force production halts and significant job losses. Adding to the uncertainty is the unpredictable duration of these tariffs—whether they will last weeks, months, or even years remains unknown.

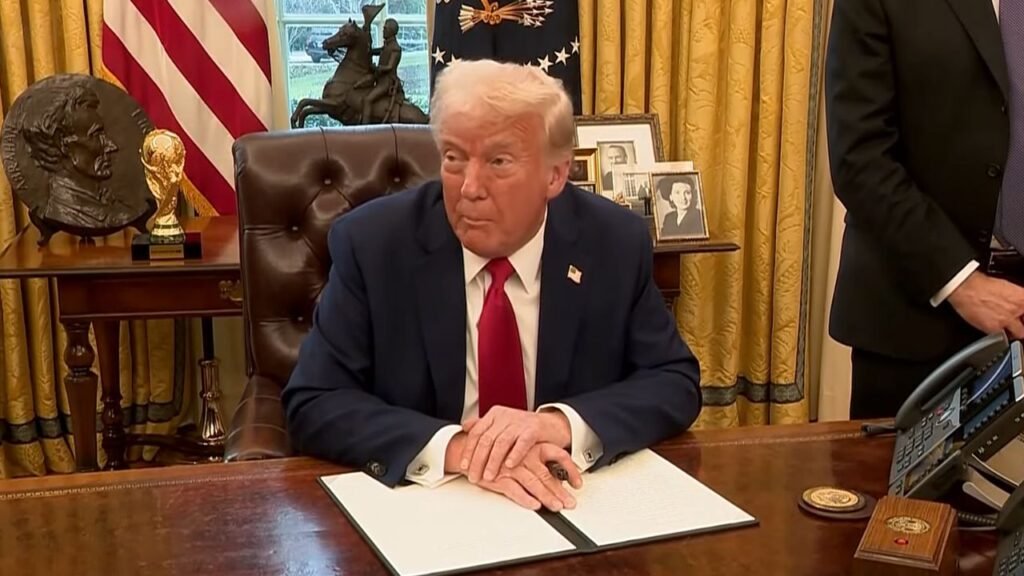

Trump’s Rationale for Tariffs: Security and Trade Imbalance

The Trump administration has positioned these tariffs as a strategic measure to address national security concerns, particularly issues like fentanyl trafficking and illegal immigration.

Additionally, the tariffs are intended to correct trade imbalances, such as the EU’s 10% tariff on U.S.-built vehicles compared to the U.S.’s 2.5% tariff on European cars. By imposing these tariffs, the administration aims to pressure trading partners into renegotiating trade terms to create a more “even playing field.”

Potential Resolution Through International Cooperation

If Canada and Mexico enhance their efforts in border security and drug trafficking prevention, there is a possibility that the tariffs could be lifted. Similarly, if the EU reduces its tariffs on U.S. vehicles, a trade war might be avoided. However, initial retaliatory measures by Canada, such as counter-tariffs, have complicated negotiations. Industry leaders, including BMW, have suggested mutual tariff reductions to minimize economic damage, but political willingness to compromise remains uncertain.

Immediate Effects on Auto Production and Prices

A 25% tariff could render North American auto production unsustainable, particularly for models dependent on parts from Mexico and Canada. For example, General Motors’ Ramos Arizpe plant in Mexico produces high-volume models like the Chevy Equinox and Blazer. Tariffs could force price increases of $9,000 or more on vehicles like the Honda CR-V, leading to unstable consumer demand and dealership inventory challenges.

The Ripple Effect on Supply Chains and Parts Manufacturing

Parts suppliers face existential threats if cross-border trade is disrupted. Many components cross borders multiple times during production, and tariffs could wipe out already slim profit margins. A breakdown in parts supply could mirror the 2021–2023 microchip shortage, leading to higher prices and inventory shortages. Facilities like GM’s Silao plant in Mexico, which manufactures Silverado pickups, are particularly vulnerable.

Case Studies: How Major Automakers Are Affected

- General Motors: 26% of U.S. sales come from Mexican factories. Key models like the Equinox and Blazer are at risk.

- Ford: Super Duty trucks (Canada) and the Mustang Mach-E (Mexico) could see significant cost increases, impacting 17% of U.S. sales.

- Nissan: 40% of U.S. sales rely on Mexican-built vehicles like the Kicks and Sentra, making tariffs a major threat.

- Toyota: Tacoma production in Mexico and RAV4 Hybrids from Canada face price surges, jeopardizing high-volume sales.

State-by-State Import Dependencies and Trade Relationships

The impact of tariffs will vary across states. Montana, for instance, sources 86% of its vehicle imports from Canada, while Texas depends on Mexico for 40% of its imports.

Oregon’s ports handle a large share of Japanese imports, and Michigan’s auto industry is deeply intertwined with Canadian supply chains. States with specialized manufacturing ties, such as Indiana’s reliance on Mexican-built SUVs, could face significant disruptions.

Long-Term Industry Outlook and Consumer Advice

While tariffs might encourage automakers to reshore production, building new U.S. factories and supply chains will take years. In the short term, consumers may face rising car prices and limited inventory.

Those considering a new vehicle purchase may benefit from waiting until trade negotiations stabilize. The crisis could also shift consumer habits, increasing the demand for used vehicles and encouraging long-term sustainability over constant new purchases.

Conclusion: Navigating Uncertainty in the Auto Market

The future of the auto industry hinges on diplomatic negotiations and adaptability. While short-term disruptions are inevitable, long-term solutions may emerge through trade rebalancing and enhanced security agreements. Both consumers and manufacturers must prepare for market volatility, making flexibility and strategic financial planning essential until stability returns.